∣AggrEnergy E-Publication Issue No.4∣ Electricity Market Overview in January 2024.dReg Market Dynamics and Future Directions

∣AggrEnergy E-Publication Issue No.4∣ Electricity Market Overview in January 2024.dReg Market Dynamics and Future Directions

1. Electricity Market Overview, January 2024

1.1 Energy Status Overview

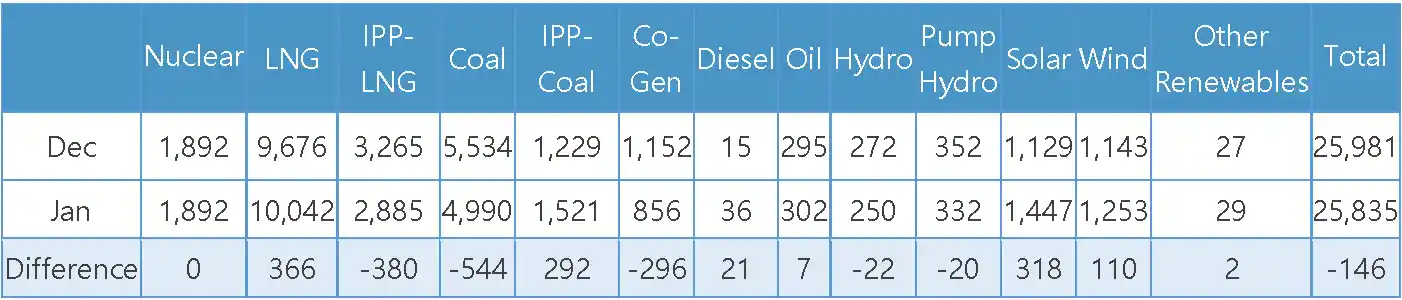

Specifically, state-owned coal-fired units produced 4,990 MW, marking a reduction of 544 MW from the preceding month, while private-owned IPP coal-fired units (IPP-Coal) experienced a modest increase of 292 MW. Conversely, gas-fired units (LNG) exhibited an opposing trend, as state-owned gas-fired units recorded a 366MW increase from the previous month, totaling 10,042 MW. However, operational private-owned gas-fired IPP units (IPP-LNG) experienced a decrease of 380 MW, registering at 2,885 MW. Notably, renewable energy generation witnessed an uptick compared to the previous month, with solar energy generation surging by 28% to 1,447 MW, while wind turbines saw a 10% increase, reaching 1,253 MW.

【Table 1】The average power generation data for December and January (MW)

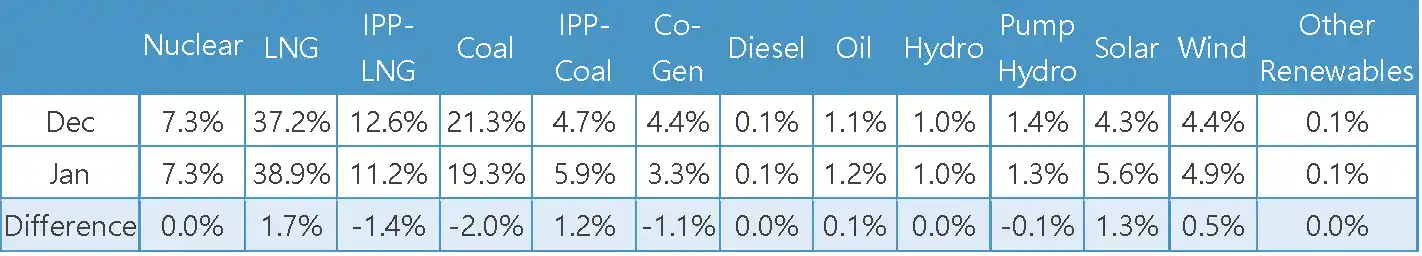

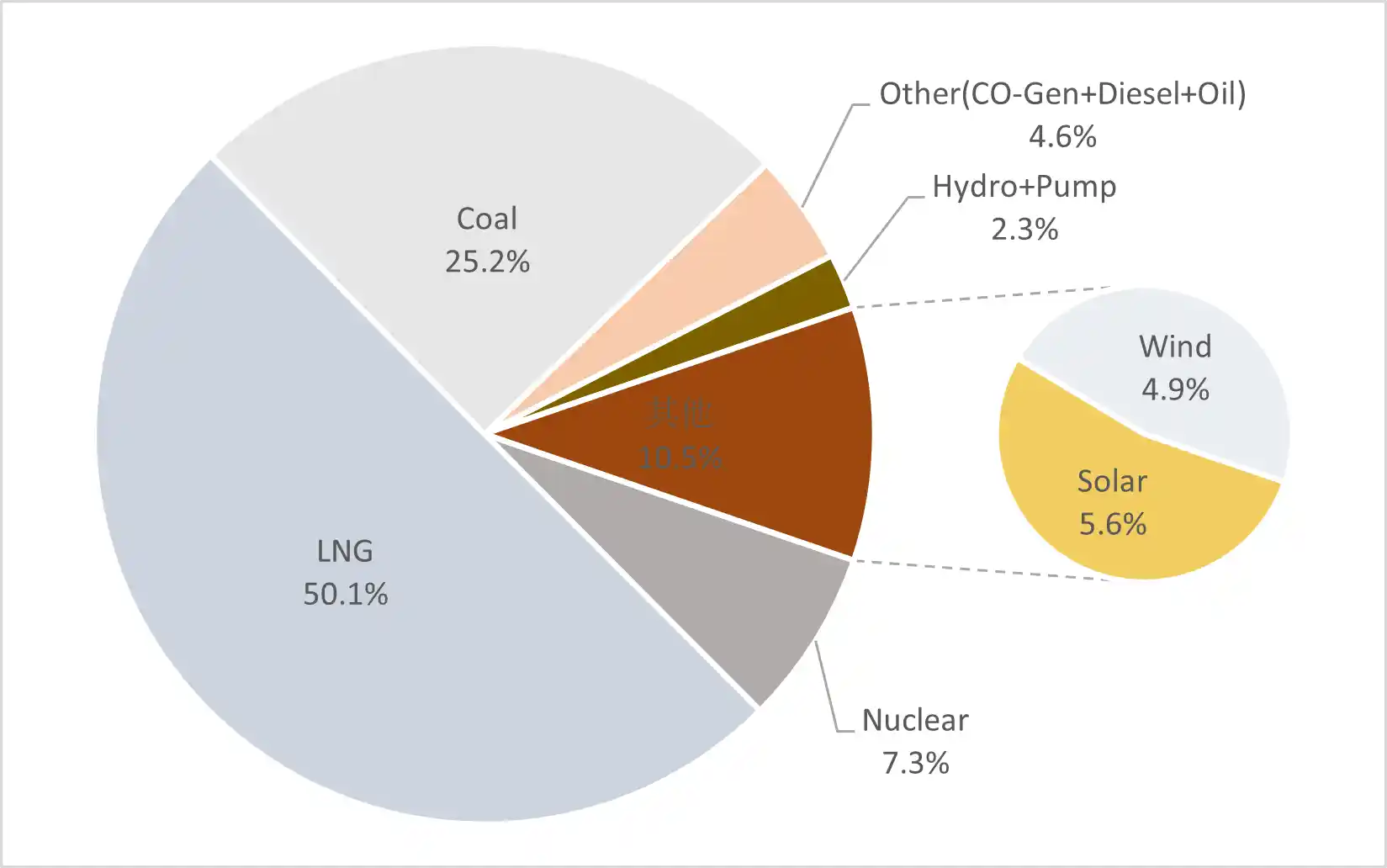

The composition of the generation mix remained relatively stable this month, as depicted in Table 2, with the most notable increase observed in state-owned gas-fired units (LNG) at 1.7%. Examining the power generation mix (Figure 1), it is evident that gas-fired units (LNG), inclusive of private-owned IPPunits (IPP-LNG), continue to hold the largest portion, comprising nearly half of the total electricity generation. Following closely, coal-fired units, including private-owned IPPunits (IPP-Coal), account for 25.2% of the total electricity generation. Notably, the proportion of renewable energy has seen an uptick, rising to 10.5% from 8.8% in the previous month, with solar and wind power individually experiencing increases from 5.6% and 4.9%, respectively.

【Table 2】The composition status of the generation mix for December and January

【Figure 1】The power generation mix of January 2024

1.2 Changes in the Electricity Market

|Dynamic Regulation Reserve (dReg) Market

With a rapid increase in contributions from private providers, supply from these private providers surpassed the market's declared demand cap of 500 MW in January. This occurrence not only resulted in market failure but also significantly impacted the stability and advancement of the energy storage industry. Notably, this issue has been already highlighted in our report titled "The Dilemma of Energy Storage Development in Taiwan" (for further information, refer to Newsletter No. 2). Acknowledging its significance, the subsequent chapter will offer a comprehensive analysis and discourse on this phenomenon, elucidating the underlying causes and its implications for future market trajectories.

|Spinning Reserve Market

This month saw the entry of a new private provider, Formosa Energy Management Corporation (FEMC) with a capacity of 8.1 MW[1]. Among existing private providers, three providers have altered their participating capacities. Two of these companies increased their participating capacities, with Swat Energy Technology and Enel X's capacities rising to 16.6 MW and 46.3 MW, respectively. Conversely, AGRE Tech reduced its participating capacity by 0.4 MW, reaching 9.2 MW. In March, there were 9 private providers, contributing to a combined capacity of 126.0 MW.

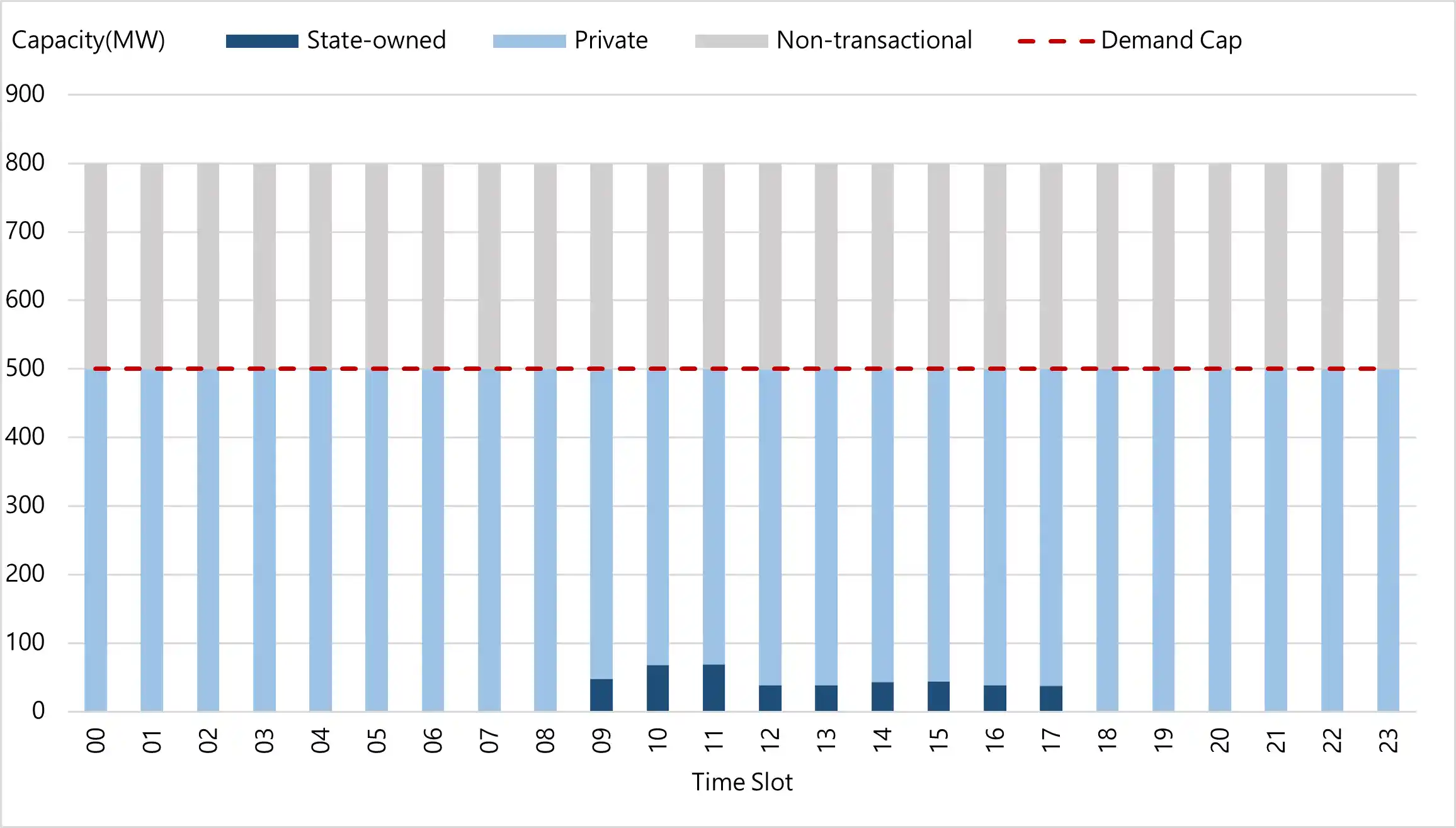

The average awarded capacity of state-owned providers this month was 358.3 MW, marking a decrease of 14.9 MW compared to the previous month. Conversely, the average awarded capacity of private-owned providers experienced a slight increase, rising by 4.3 MW to 86.5 MW. Meanwhile, non-transactional awarded capacity decreased to 555.4MW from 574.3 MW in the previous month. Notably, non-transactional awards continued to dominate the market, constituting 56% of the total, whereas private-owned counterparts represented only 9%. It is noteworthy that the clearing price for this month decreased to 248TWD from 262TWD in December of the previous year.

|Supplemental Reserve Market

No new entrants entered the energy market during this month. However, Energy Helper TCC and Enel X, 2 of the existing providers, have increased participating capacities by 2.0 MW and 9.9 MW, respectively, bringing total capacities to 42.0 MW and 58.1 MW, respectively. As of the end of January, the total capacity of the market has become 251.4 MW, with 10 private providers.

During this month, the average awarded capacity of the state-owned providers amounted to 827.6 MW, marking a decrease of 17.5 MW compared to the previous month. Conversely, the average awarded capacity of private providers increased by 10.6 MW, reaching 142.8 MW, while the average awarded capacity of non-transactional providers saw a slight uptick, rising by 9.3 MW to 29.7 MW. Different from the Spinning Reserve, the Supplemental Reserve was predominantly comprised of state-owned providers, accounting for 83%, and private providers, making up 14%. The clearing price for this month decreased to NT$239 from NT$256 last month.

|Market Dynamics of Energy-shifting with Dynamic Regulation (E-dReg)

There are no new entrants into the market this month, with a total participating capacity of 116.0 MW. In comparison to other services, the market price remained notably stable, with an average settlement price of NT$600.

[1] The figures of the content were based on the data collected on Jan 31th, 2024

2. dReg Market Dynamics and Future Directions

2.1 Changes in Private Sector Participation and Market Dynamics in January

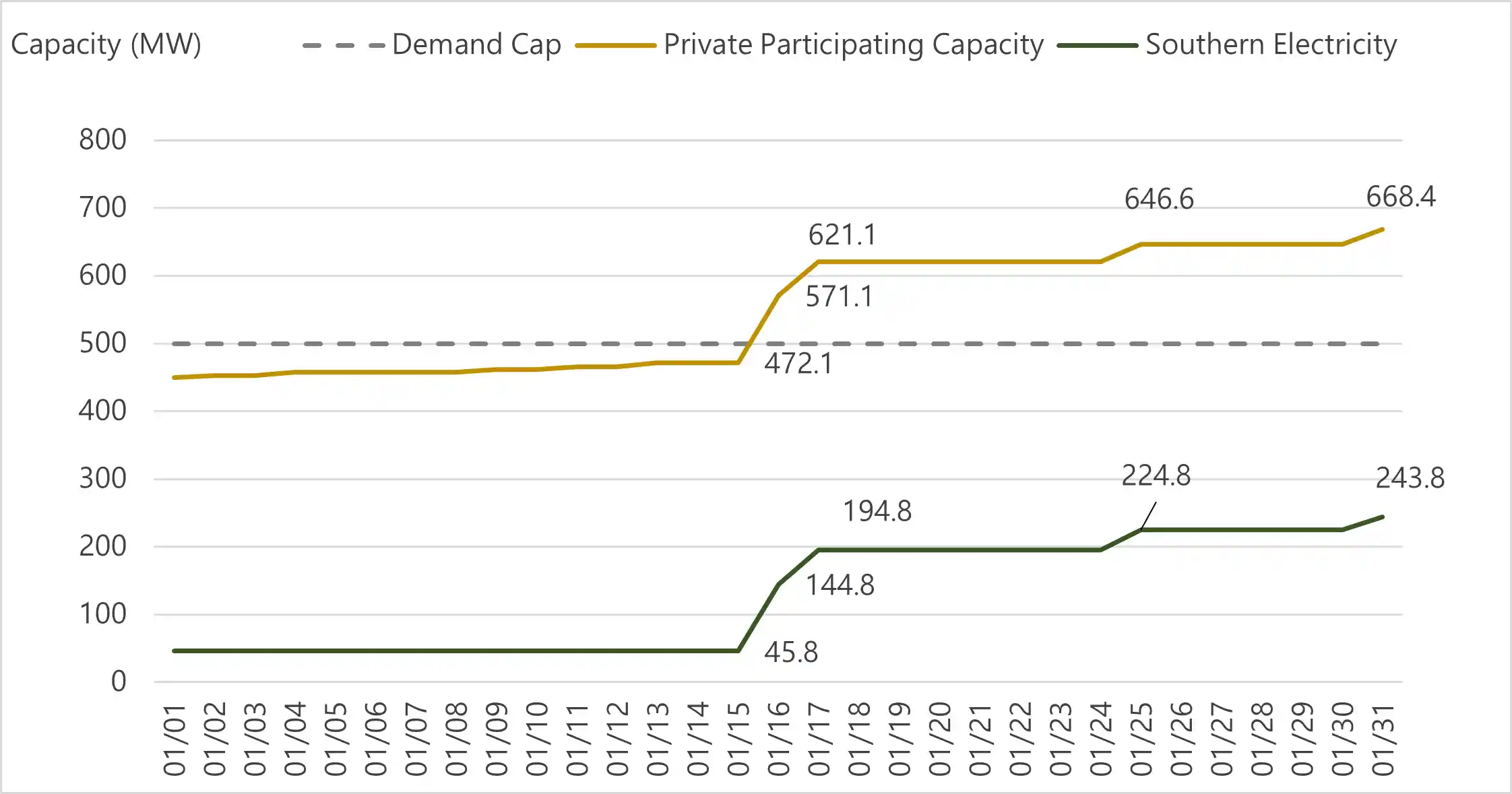

By the end of December 2023, the amount of participating capacity from private providers in Dynamics Regulation Reserve (hereinafter referred to as dReg) reached 449.9 MW, leaving only 50.1 MW of headroom within Taipower's announced demand cap of 500 MW. Private participating capacity reached 668.4 MW by the end of this month, an increase of 218.5 MW compared to the previous month. Three new providers entered this month: Green Shepherd, TPE Energy, and Fontai Energy, with capacities of 6.0 MW, 4.5 MW, and 4.3 MW, respectively. In addition, Southern Electricity Corporation, ATE Energy, Seetel New Energy, and Acmepoint Energy Services increased their capacities by 198.0 MW, 4.9 MW, 2.8 MW, and 2.5 MW, respectively.

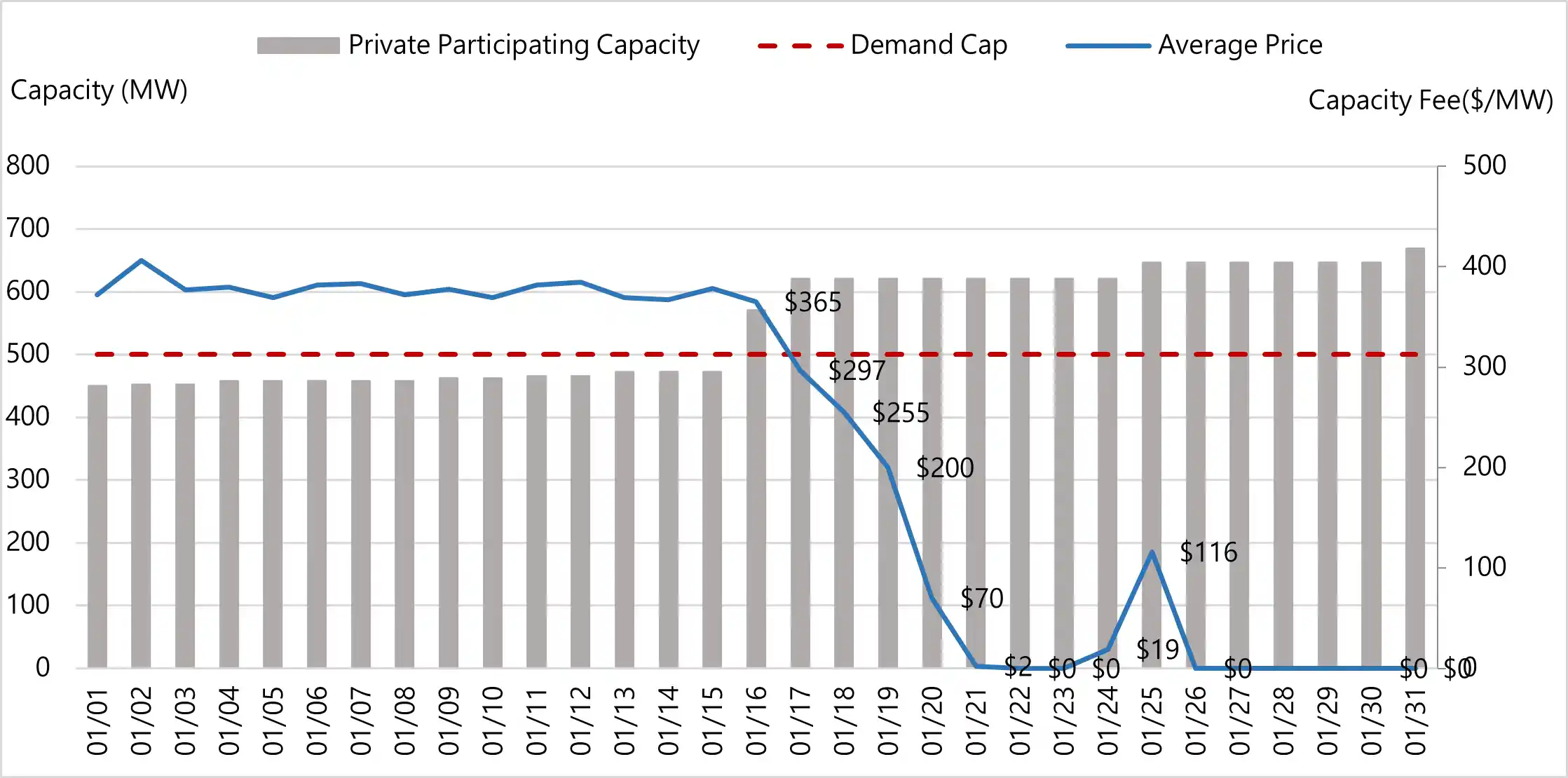

The capacity changes made by Southern Electricity Corporation were particularly noteworthy. On January 16th, 17th, 25th, and 31st, it increased its capacity by 99.0 MW, 50.0 MW, 30.0 MW, and 19.0MW, respectively, culminating in a total capacity of 243.8MW. Among these, the capacity change on the 16th exceeded the market demand cap, reaching a total of 571.1 MW. Figure 2 illustrates the changes in private participating capacity within the dReg market this month, aligning with the changes made by Southern Electricity Company.

【Figure 2】Changes in dReg Private Supply and Southern Electricity Corporation Capacity

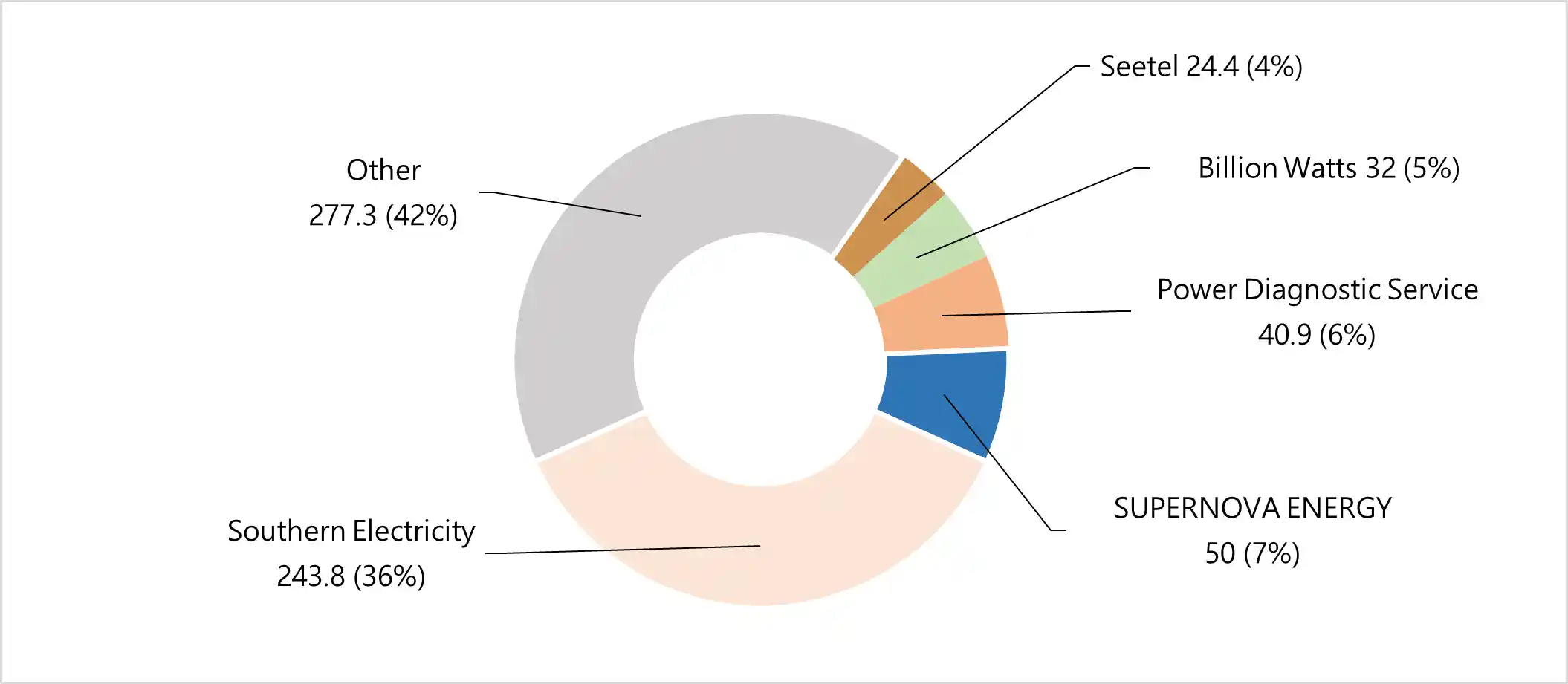

Additionally, Eco Energy's participating capacity decreased from 4.5 MW to 0 MW on January 25th, leading to its removal from the list of qualified providers. At the end of this month, there were 62 dReg private providers. Figure 3 shows the current statistics of private providers and their capacities, with the top 5 providers accounting for 58% of the total capacity. Southern Electricity Corporation (243.8 MW) leads in capacity, accounting for 36% of total participating capacities.

【Figure 3】Current statistics regarding private providers and their capacities (MW)

2.2 dReg Price Variations and Analysis

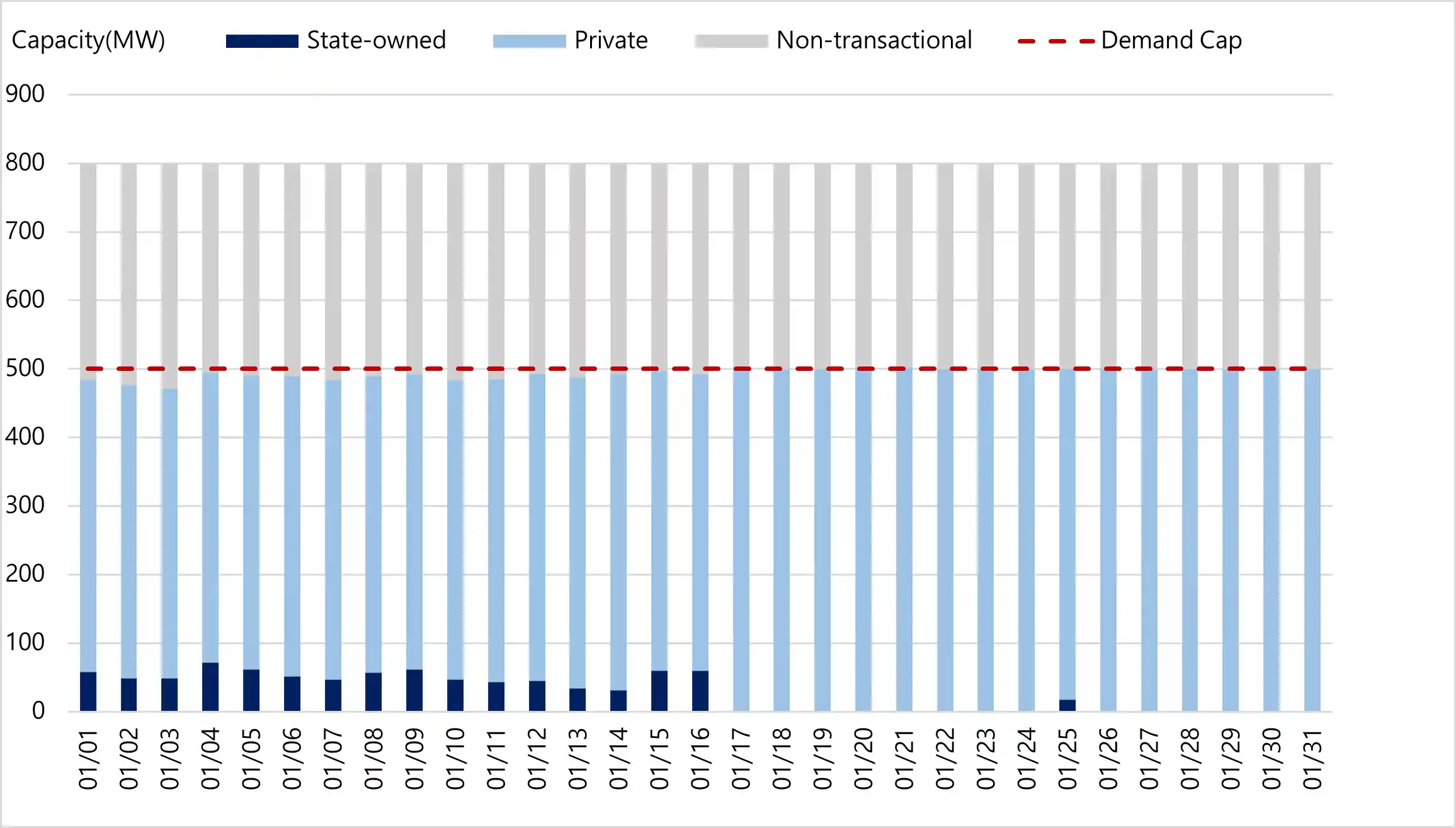

When the market experiences a supply-demand imbalance, private providers tend to lower their bid prices to secure bids, resulting in a decline in clearing prices or even down to zero. Figure 4 demonstrates the daily comparison of private participating capacity and average prices. Starting from January 16th, the private participating capacity (represented by gray bars) exceeded the market demand cap (red dashed line), triggering a decline in clearing prices (blue line), with prices reaching zero from the 22nd onwards. Notably, after the capacity fee was reduced to zero, prices rebounded to NT$19 and NT$116 on the 24th and 25th. Additionally, bids from state-owned providers have remained at zero since the 17th, with occasional bids appearing only on the 24th and 25th (as shown in Figure 5).

【Figure 4】Comparison of dReg Private Participating Capacity and Average Price

【Figure 5】Daily Awarded Capacity in the dReg Market[2]

During this period, private providers did not directly push prices to zero but instead chose to test the market's price floor. On the one hand, they were gauging the pricing approaches of other private providers and anticipating whether there would be any strategic responses from Taipower. This is reflected in the prices on the 17th. It was the first auction after the market was oversupplied, with an average clearing price of NT$297. It is estimated that private providers have not yet significantly adjusted their pricing strategies at that time.

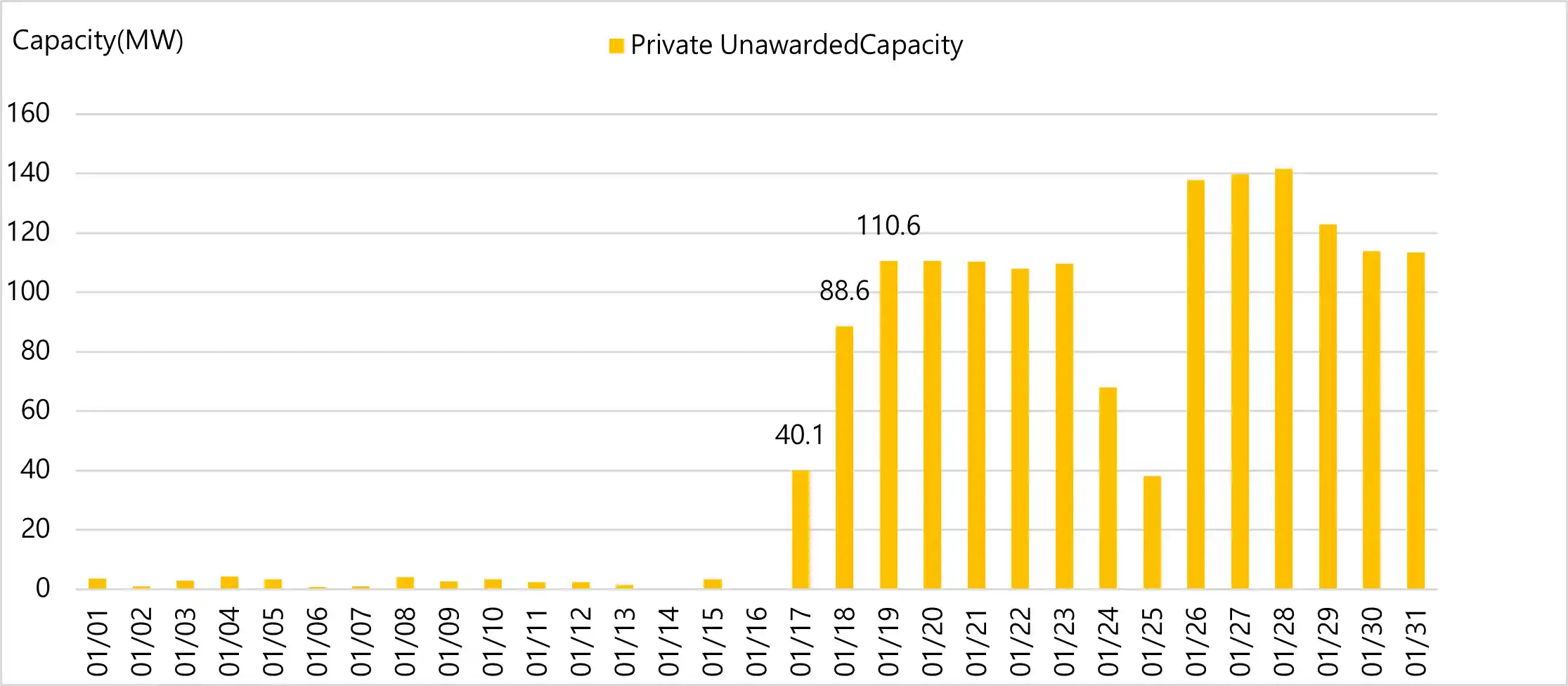

At this time, the daily unawarded capacity from private providers (Figure 6) would impact their pricing strategies the following day. On the 17th, unawarded capacity from private providers increased to 40.1 MW, significantly higher than previous values, compelling them to lower their bids and resulting in a decrease in daily average prices (Figure 4). However, unawarded capacity from private providers continued to increase, particularly on the 19th, reaching 110.6 MW, leading private providers to adopt a more conservative pricing approach, causing the average clearing price on the 20th to drop to NT$70. Nonetheless, on the 20th, 110.6 MW of unawarded capacity forced private providers to reduce their bids further, resulting in a price plummet to NT$2 on the 21st. Eventually, the majority of private providers lowered their bid price to zero, leading the price down to zero through on the 22nd.

【Figure 6】Daily private unawarded capacity in dReg market (MW)

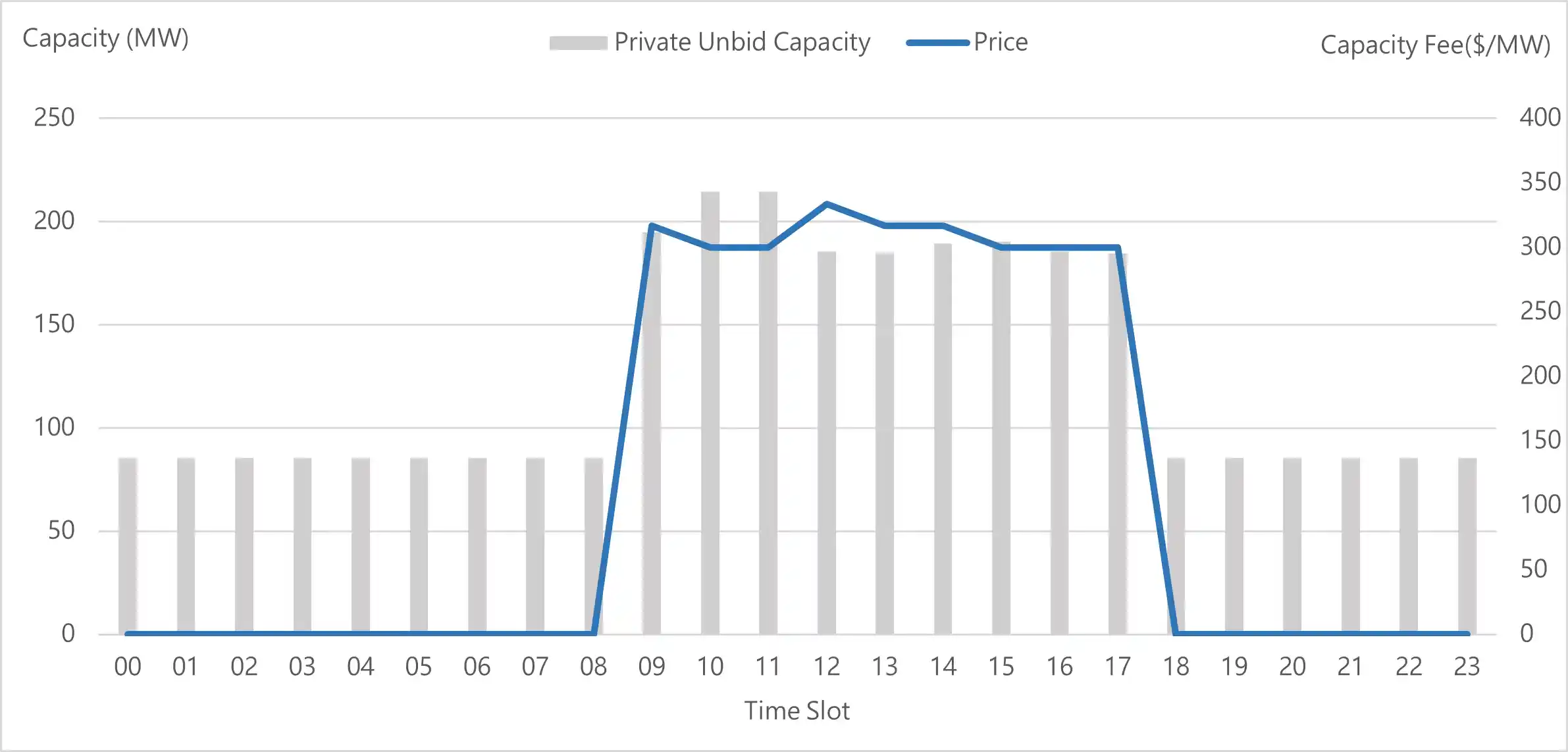

The prices on the 24th and 25th were related to the private unbid capacity. On these 2 days, there were periods with a large amount of private unbid. During this period, All state-owned providers were successfully awarded bids, and market prices were above zero. This situation occurred only from 9:00 to 10:00 on the 24th and continued from 9:00 to 17:00 on the 25th. The latter had an average private unbid capacity of 126 MW, with an average unawarded capacity of only 36 MW. Figure 7 shows the comparison of private unbid capacity and prices per time slot of the day. When private unbid capacity (gray bars) exceeds 100 MW, the price for that time slot (blue line segment) rose, consistent with the periods when state-owned providers were awarded (Figure 8).

【Figure 7】Comparison of Private Unbid Capacity and Prices on January 25th

【Figure 8】Overview of Awarded Capacity by Time Slot on January 25th

Additionally, the dReg market has exhibited capacity allocation scenarios[3], where the proportion of private capacity bids at a price of zero dollars is used to determine the proportion of awarded bids relative to market demand. This mechanism indicates that even if providers bid at zero dollars, some capacity may still not be awarded. For Example, at 10 a.m. on January 22nd, the total bidding capacity reached 601.0 MW, and bidding capacity at zero dollars stood at 585.3 MW, resulting in an actual bidding ratio of 85% (i.e., 500 / 585.3 = 85%).

[2] Figure 5 shows the average awarded capacity for various types of providers. The state-owned providers were awarded bids for only 2 hours, which is a relatively low proportion. Therefore, this part is relatively faint in the bar chart.

[3] Grid-connected Energy Storage Three-party Platform Meeting (Taipower, 202401)

2.3 Taipower's Response Measures (Short-term and Long-term Plans)

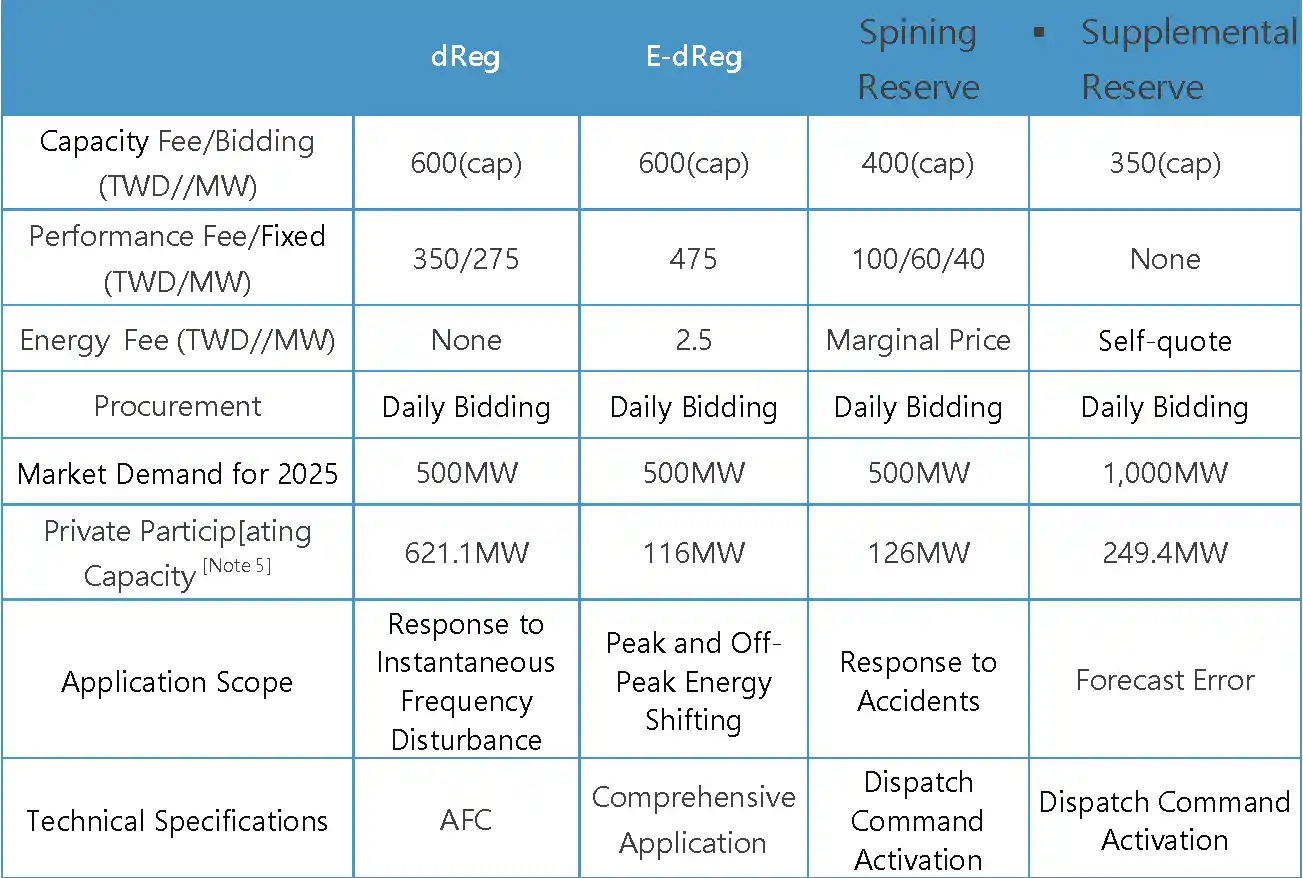

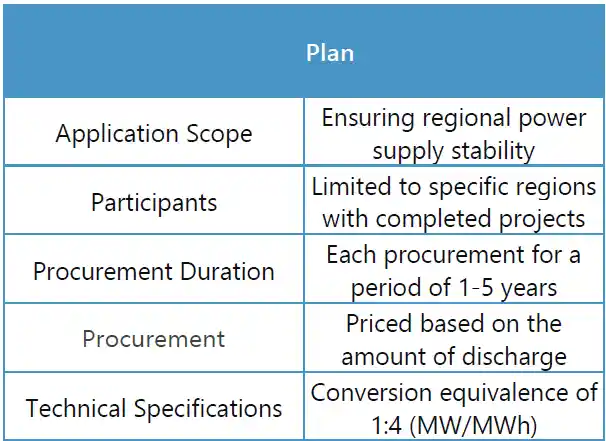

Facing the current oversupply in the dReg market, Taipower has proposed 2 measures : in the short term, private providers can choose to shift from dReg to Enhanced Dynamic Regulation (hereinafter referred to as E-dReg) or to Spining Reserve (Table 3). In the medium to long term, the implementation of Virtual Power Plants (VPPs) is under consideration. Although these short-term transition plans may appear to alleviate the oversupply issue in the dReg market, further analysis reveals that moving to E-dReg could further exacerbate the imbalance in the market structure.

【Table 3】Overview of Ancillary Services Products %[4]

Firstly, E-dReg sets a minimum capacity limit, initially set at 5 MW /12.5 MWh, which requires private providers to simultaneously meet both grid integration requirements (halving of capacity) and equivalent capacity conversion limits (1 : 2.5). For example, the actual participating capacity is only 8MW for a 20MW dReg site converting to E-dReg without increasing the total battery energy (MWh). Although Taipower has revised the participation specifications for E-dReg, lowering the minimum capacity threshold to 1 MW (originally 5 MW), it remains a significant challenge for many private providers. Furthermore, according to Taipower's public briefing on February 6th, if dReg private providers switch to the E-dReg market, they cannot return to the original market. Such a regulatory framework constrains the strategic options available to providers, limiting their flexibility to adjust market strategies in response to demand.

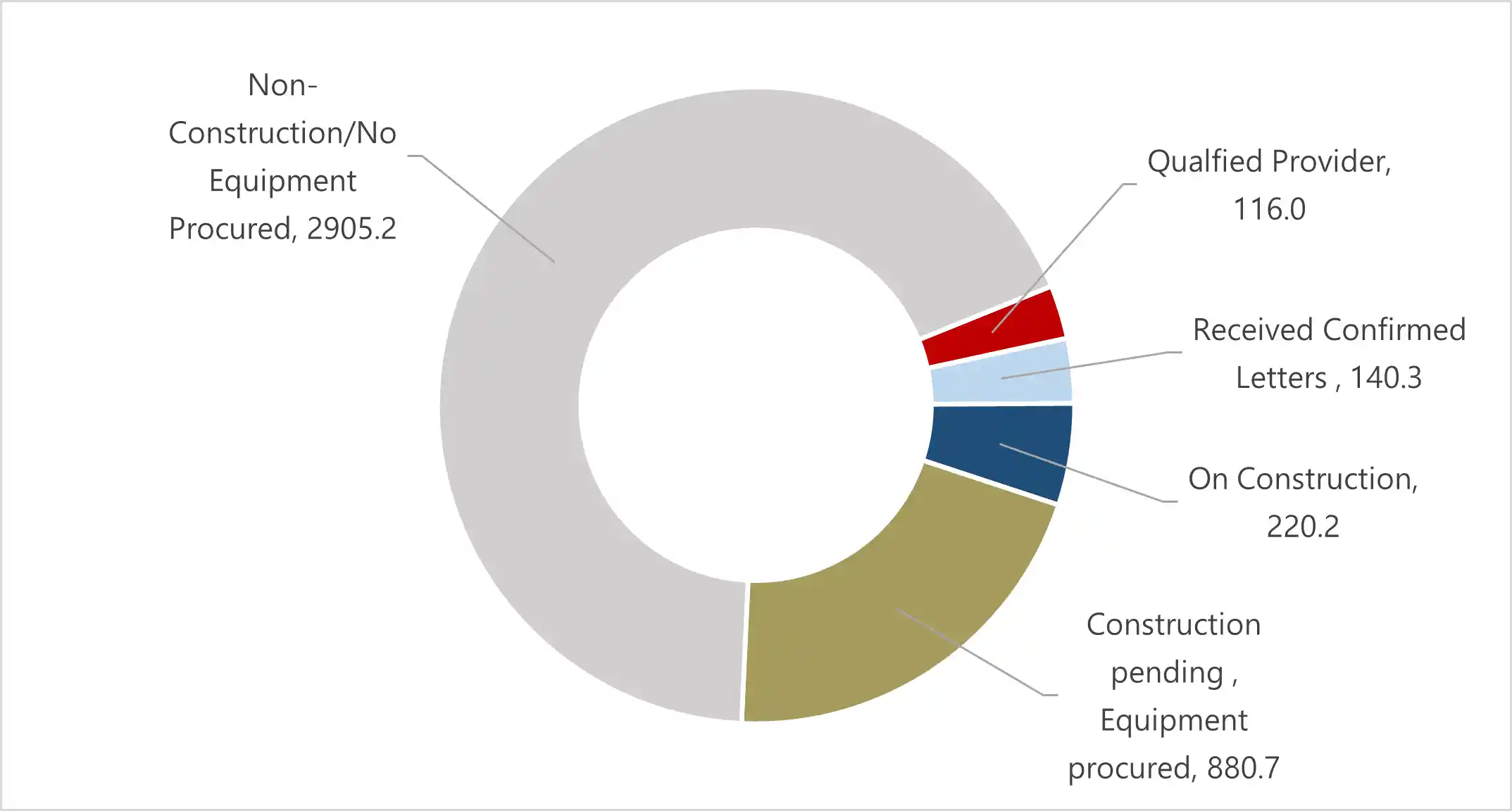

Furthermore, the E-dReg market itself faces the risk of oversupply. Figure 9 shows the statistics of E-dReg applications for installation. Currently, the applied capacity stands at 4262.4 MW, which is 8.5 times the demand ceiling. Among them, 116.0 MW has already been operated, along with 140.3 MW that received confirmed letters and 220.2 MW under construction, totaling 476.5 MW, leaving only 23.5 MW headroom within the demand ceiling. In such circumstances, allowing dReg to convert E-dReg will only accelerate market saturation.

【Figure 9】Request for Approval and Installed Status of E-dreg[6]

Regarding Spinning Reserve , being considered as a short-term alternative, there is currently a lack of clear implementation details. Although this product does not have a 2.5-hour battery capacity restriction, the lack of sufficient incentives seems to dampen its appeal. For medium-term solutions, the application of virtual power plants (VPP) is proposed. The concept is to open up the energy storage power plant project initially planned by Taipower in Shen'ao for private providers, with the aim to to alleviate dReg market’s congestion. The construction of this power plant is to address regional supply-demand imbalances. Taipower's proposed transfer plan is shown in Table 4:

【Table 4】Virtual Power Plant (VPP) Scheme[7]

【Figure10】Distribution Map of Energy Storage Facilities Across Taiwan[8]

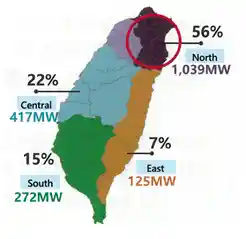

Given geographical constraints, among the currently interconnected facilities, those located in the region represent 56% (Figure 10). Simultaneously, there are constraints on equivalent capacity conversion (1 : 4), indicating that the actual capacity of a 20MW dReg facility participating in this program can only reach 5 MW without increasing the total battery energy. This threshold even surpasses the requirements of E-dReg (1:2.5). Consequently, qualifying operators must sacrifice PCS power to meet the requirements of the northeast power grid. Moreover, the lack of specific implementation and revenue details makes it difficult for operators to assess the feasibility of transitioning to this program.

[4] In response to the surplus of high-power energy storage systems and the construction response from GESA. (Taipower 202401)

[5] The participation data in Table 3 is as of January 21st, which slightly differs from the values in this document (data as of January 31st).

[6] [7] [8] The second "Grid-connected Energy Storage Three-party Platform Meeting" in 2024. (Taipower 202401).

Copyright © 2024 AggrEnergy

AggrEnergy

AggrEnergy leverages its core competencies in software development and information communication to deliver comprehensive services, enabling resource-endowed enterprises to swiftly penetrate the electricity market and minimize the integration barriers with Taipower ancillary service. As renewable energy gains prominence, Taiwan's energy landscape is transitioning towards Distributed Energy Resources (DER), which will be integrated into the grid in a service-oriented manner. By amalgamating generators, energy storage, demand response, and other power services into virtual power plants, AggrEnergy facilitates power aggregation and transactions in the progressively liberalized electricity market, enhancing Taiwan's ability to flexibly regulate energy supply and demand through real-time dispatching technology. Aggr introduces a novel business service model for prospective participants in the electricity market, serving as a vital conduit between Taipower and diverse power resources, thereby fostering increased participation in trading platforms and serving as a stabilizing force within the grid. Please referred to AggrEnergy website for more informaton (https://www.aggr.energy/zh-TW).

More related articles