Ministry of Environmental Completes Draft of Carbon Fee Charging Measures

Ministry of Environmental Completes Draft of Carbon Fee Charging Measures

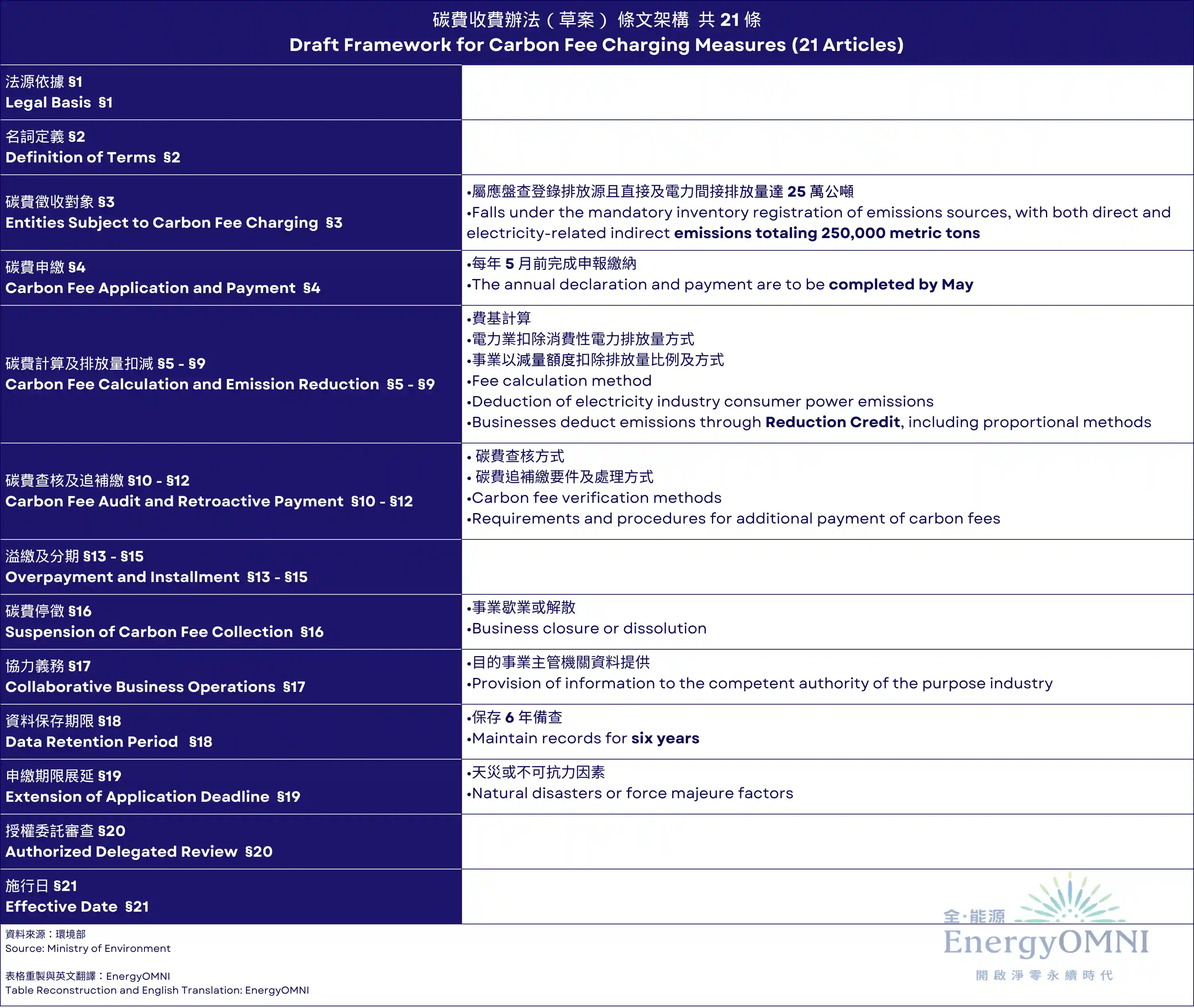

To ensure the timely implementation of carbon fee collection, the Ministry of Environmental released the "Guidelines for Establishing Carbon Fee Rate Review Councils" on December 1, 2023. The introduced draft of the carbon fee charging measures (referred to as the charging measures) specifies that power and large manufacturing industries with annual emissions exceeding 25,000 metric tons of CO2 equivalent will be subject to fees. Commencing in the year 2024, these entities' greenhouse gas (GHG) emissions will be factored into the calculation, marking the initiation of Taiwan's era of carbon pricing.

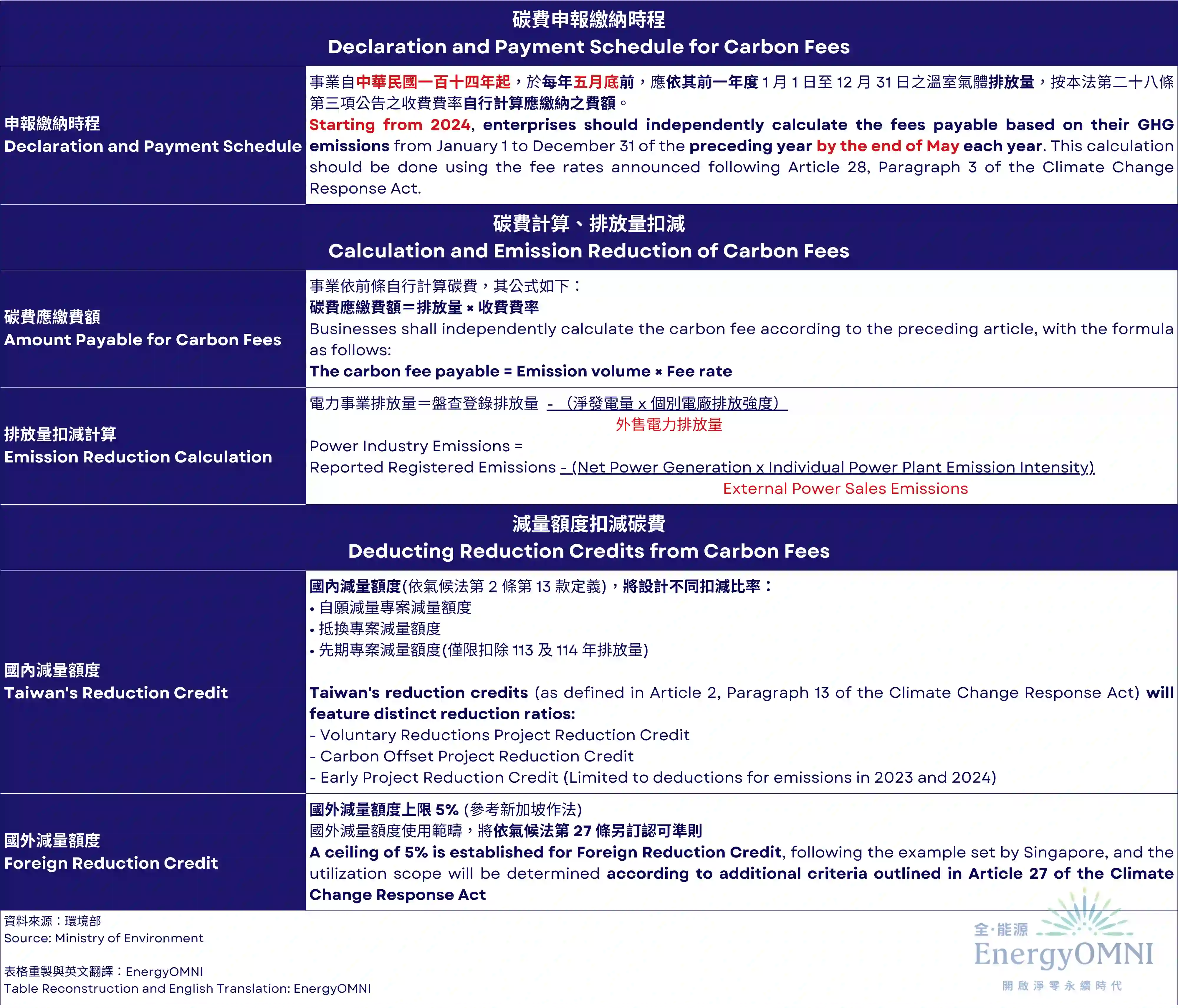

In accordance with Article 28 of the Climate Change Response Act, a carbon fee may be levied in stages on emission sources emitting greenhouse gases (GHG). The Ministry of Environmental explains that when calculating the carbon fee, the emission amount of GHG for the previous year should be multiplied by the fee rate announced by the competent authority. This calculation yields the amount of carbon fee to be paid. The power industry can also deduct its emission amount by providing proof of emission from power consumption when declaring the carbon fee.

The method for auditing, supplementing, and retroactively collecting carbon fees is also delegated to the competent authority. During the audit process, businesses may be notified to provide relevant information within a specified period. If underpayment or non-payment is discovered upon audit, the charging entity should be notified to retroactively collect or given a deadline for supplementing the carbon fee.

Climate Change Response Act Article 30 establishes the application of Taiwan Reduction Credits for Emission Reduction, encompassing reduction credits obtained from Voluntary Emission Reduction Projects, Carbon Offset Projects, and early project reduction quotas. The planned use of early project reduction credits is limited to emission reductions in 2024 and 2033. Moreover, the reduction credit deduction rates and ceilings for various project types are subject to further discussion and confirmation with stakeholders.

Article 27 of the Climate Change Response Act also outlines provisions for using foreign reduction credits to offset carbon fees. The current international practices regarding the deduction of carbon fees are considered, specifying that foreign reduction credits used to offset carbon fees must be approved by the central competent authority and are limited to 5% of the total fee-requiring emissions. The fee collection method also incorporates provisions for extension due to natural disasters or other force majeure, data retention periods, refund of overpaid carbon fees, settlement during suspension of business, and delegation of authority to specialized agencies.

Ministry of Environmental has indicated that, following Article 29 of the Climate Change Response Act, entities subject to carbon fees, by adopting measures such as transitioning to low-carbon fuels, implementing negative emission technologies, enhancing energy efficiency, utilizing renewable energy, or process improvements leading to significant GHG reductions aligned with the central competent authority's specified targets, may apply for approval of a "preferential rate" through the submission of voluntary emission reduction plans. Recognizing variations in reduction potentials across different industries, the Ministry of Environmental has engaged in dialogues and consultations with associations representing sectors such as petrochemicals, synthetic fibers, paper, silk dyeing, cement, steel, semiconductor, electronics, and food industries since July 2023. The suggestions proposed by these associations will serve as valuable references in the planning and design of "specified targets."

Reference: Ministry of Environmental